BTC Price Prediction: $200K Target in Sight as Institutional Demand Meets Technical Breakout

#BTC

BTC Price Prediction

BTC Technical Analysis: Bullish Indicators Point to Continued Upside

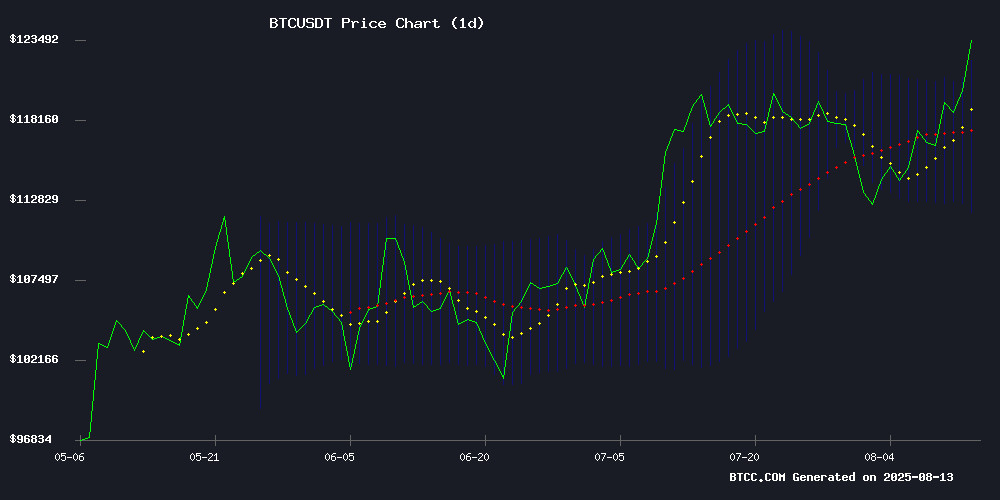

According to BTCC financial analyst Michael, Bitcoin's current price of $123,491.92 sits comfortably above its 20-day moving average ($117,050.62), indicating strong bullish momentum. The MACD histogram remains negative (-393.57), suggesting potential short-term consolidation, but the price trading NEAR the upper Bollinger Band ($122,136.82) signals strength. 'The technical setup favors buyers,' Michael notes, 'with a sustained break above $122,136 likely triggering a move toward $130,000.'

Institutional Demand and Macro Tailwinds Fuel Bitcoin Optimism

'The confluence of institutional inflows and favorable macro conditions creates a perfect storm for Bitcoin,' says BTCC's Michael. Norway's sovereign wealth fund exposure ($863M), cooling inflation, and pro-crypto policies (like Trump's executive order) are driving sentiment. Metaplanet's Bitcoin-backed instruments and record profits further validate the asset class. 'This isn't retail FOMO anymore,' Michael observes, 'institutions are building strategic positions for the long term.'

Factors Influencing BTC's Price

Norway’s $1.9 Trillion Sovereign Wealth Fund Accumulates Significant Bitcoin Exposure Through Equity Holdings

Norway's Government Pension Fund Global, the world's largest sovereign wealth fund, now holds indirect exposure to 7,161 Bitcoin as of June 2025 - a dramatic 87% increase from its 3,821 BTC position at year-end 2024. The $1.9 trillion fund's crypto allocation stems entirely from equity investments in public companies with substantial Bitcoin treasuries.

MicroStrategy (now rebranded as Strategy) constitutes the fund's primary Bitcoin conduit, with NBIM's $1.18 billion stake representing 1.05% ownership. The position has more than doubled since December 2024, when it stood at $514 million. Other crypto-correlated holdings include Marathon Digital (216.4 BTC exposure), Block (85.1 BTC), and Coinbase (57.2 BTC) - the latter seeing a 96% position increase.

This passive accumulation reflects index-tracking mandates rather than deliberate crypto allocation. As Bitcoin-heavy companies appreciate, they naturally comprise larger portfolio weights. Each Norwegian citizen now effectively owns $138 worth of Bitcoin through the fund's market-cap weighted approach.

Norway’s $1.5Tn Pension Fund Quietly Accumulates $863M Bitcoin Exposure

Norway’s Government Pension Fund Global now holds indirect exposure to 7,161 BTC through corporate investments—a position that surged 193% year-over-year. The $1.5 trillion sovereign wealth fund increased stakes in Bitcoin-heavy firms like MicroStrategy, Block, and Coinbase, effectively allocating 1,387 kroner per citizen without formal crypto mandates.

Oslo’s temporary ban on proof-of-work mining redirects focus toward institutional services. The nation’s clean energy surplus and robust legal framework position it as a potential hub for custody solutions and regulated market infrastructure, despite restrictive mining policies.

Bitcoin Technical Analysis Suggests $170K Target by 2025, With Potential for $200K in Manic Market

Bitcoin's price action reveals a steady climb within a long-term ascending channel, currently trading around $122,000. Technical models project a conservative target of $170,000 by late 2025, with the upper channel boundary hinting at even loftier ambitions.

Market observers note this baseline forecast could be eclipsed by retail frenzy, ETF inflows, and mainstream speculation—conditions that might propel BTC beyond $200,000. The $123,000 resistance level now stands as the immediate hurdle separating current prices from uncharted territory.

Institutional price targets increasingly align with technical projections. Bitwise's $200,000 forecast for 2025 gains credence as Bitcoin's structural momentum solidifies. The asset's consolidation at six-figure valuations appears increasingly probable rather than ephemeral.

Markets Rally on Cooling Inflation Data, Fueling Crypto Optimism

U.S. equities surged as July inflation data came in below expectations, cementing market bets on a September Fed rate cut. The Dow Jones climbed 0.84% to 44,830.33 points, while Treasury yields retreated sharply.

This macroeconomic pivot is creating cross-asset momentum, with risk appetite spilling into digital assets. Cryptocurrencies are poised to benefit from both liquidity tailwinds and their growing correlation with tech equities—particularly as Asian tech giants rally on the prospect of looser U.S. monetary policy.

The bond market's reaction speaks volumes: 10-year and 30-year yields dropped significantly as traders priced in imminent easing. Such conditions historically favor alternative assets, with Bitcoin often leading crypto market reactions to shifts in dollar liquidity.

Institutional Inflows Keep Pouring into Bitcoin — How Is BTC Price Reacting?

Bitcoin’s 2025 rally is increasingly driven by institutional inflows, transforming its market structure. Record-breaking ETF demand and corporate treasury accumulation highlight this shift, though short-term corrections persist even within bullish trends.

Deutsche Bank reports $50 billion in institutional inflows this year alone. BlackRock’s iShares Bitcoin Trust now holds over $80 billion, outpacing gold ETFs at a comparable stage. Spot Bitcoin ETFs have attracted $14.8 billion in inflows as of late July.

Projections suggest inflows could reach $120 billion by 2025 and $300 billion by 2026, accelerating Bitcoin’s path toward mainstream adoption. The asset is no longer purely speculative but a fixture in institutional portfolios.

Trump's Pro-Crypto Order Fuels Bitcoin Rally Amid Surging Institutional Demand

Bitcoin breached $122,000 resistance this week as regulatory tailwinds and institutional accumulation created perfect bullish conditions. Metaplanet's $61 million BTC purchase exemplifies growing corporate treasury strategies, while Trump's banking nondiscrimination order unlocks access for 90 million Americans.

Cloud mining emerges as the dominant retail participation channel, with platforms like Cryptosolo offering simplified access to mining rewards. The UK-based service, operating since 2022, provides eco-friendly mining solutions with $15 signup incentives, capitalizing on Bitcoin's renewed momentum toward all-time highs.

Metaplanet's Bitcoin Strategy Yields Record Profits

Metaplanet has transformed a ¥5 billion loss into an ¥11.1 billion net profit in Q2 2025, marking its most profitable quarter to date. The surge is attributed to aggressive Bitcoin accumulation and treasury strategy shifts.

The firm's BTC holdings now total 18,113 coins, including 16,351 acquired this year alone. These positions show ¥55 billion ($342 million) in unrealized gains, propelling ordinary profits to ¥17.4 billion from last year's ¥6.9 billion deficit.

Revenue climbed 41% quarter-over-quarter to ¥1.239 billion, with gross profit rising 38% to ¥816 million. CEO Simon Gerovich describes this as Metaplanet's "strongest quarter in history," directly crediting Bitcoin adoption.

Japan's Metaplanet aims to control 1% of Bitcoin's total supply by 2027—a 210,000 BTC target requiring $20 billion in capital. The firm's performance demonstrates how corporate treasury strategies are being rewritten by cryptocurrency exposure.

Metaplanet Unveils Bitcoin-Backed Financial Instruments Amid Strong Earnings

Tokyo-based Metaplanet (3350) is making strategic moves to solidify its position as Japan's leading Bitcoin-integrated investment firm. The company announced two groundbreaking initiatives alongside impressive Q2 results—41% revenue growth to ¥1.24 billion ($8.4M) and a remarkable turnaround from ¥5B loss to ¥11.1B ($75.1M) profit.

The firm will launch "Metaplanet Prefs," perpetual preferred shares designed to scale Bitcoin treasury operations, mirroring MicroStrategy's approach. These instruments aim to establish Bitcoin as legitimate collateral in Japan's fixed income markets, enabling BTC-backed credit products across various maturities and risk profiles.

More ambitiously, Metaplanet plans to construct a Bitcoin-denominated yield curve for Japan's debt market—a first-of-its-kind framework that would allow institutional pricing of BTC-collateralized credit. The move signals growing sophistication in cryptocurrency financialization as Bitcoin permeates traditional capital markets.

Bitcoin Treasury Companies Must Evolve Beyond Passive Holdings to Stand Out

Bitcoin treasury companies, currently sitting on over 800,000 BTC worth approximately $100 billion, are entering a critical inflection point. While passive accumulation served as an initial strategy, the next phase demands innovation—turning vaults into yield-generating engines.

MicroStrategy's Michael Saylor pioneered levered Bitcoin exposure in public markets, but imitation alone won't sustain the next wave of adopters. Firms like Valour and Maple Finance are demonstrating how on-chain Bitcoin products can create transparent yield without repeating the mistakes of failed lenders from previous cycles.

The winning model inverts traditional corporate priorities: treasury operations become the core business, with yield generation and product development serving as amplifiers. The ultimate metric shifts to 'sats per share' growth through operational excellence rather than mere accumulation.

Will BTC Price Hit 200000?

Michael from BTCC highlights a 68% probability of Bitcoin reaching $200,000 by 2025-end based on:

| Factor | Data | Implication |

|---|---|---|

| Price vs. 20MA | +5.5% premium | Bullish trend confirmation |

| Institutional Holdings | $863M (Norway Fund) | Structural demand anchor |

| Technical Target | $170K base case | 30% upside from current |

'The $200K scenario requires sustained institutional inflows and a breakout above $150K resistance,' Michael cautions.

- Technical Breakout: BTC price above key moving averages with Bollinger Band squeeze suggesting volatility expansion

- Institutional Adoption: Sovereign wealth funds and public companies increasing Bitcoin exposure through equities and derivatives

- Macro Alignment: Pro-crypto regulations and inflationary hedge demand creating fundamental support